GST is known as Goods and Services Tax. It is a skewed tax which has replaced many skewed taxes in India including excise duty, VAT, Prasad tax etc. The Goods and Services Tax Act was passed within the Parliament on 20th March 2017 and came into effect on 1st July. 2017.

In different words, Goods and Services Tax (GST) is levied on the distribution of products and offerings. The Goods and Services Tax law in India is a comprehensive, multi-level, purely based tax on vacation spot-primarily that is levied on each duty increase. The GST is an unmarried household skewing tax regulation for the entire United States.

Under the GST regime, every factor of sale is taxed. Central GST and State GST are charged in case of intra-nation income. All intra-nation income is chargeable to Integrated GST.

Now, let us understand the definition of Goods and Services Tax in detail, as explained above.

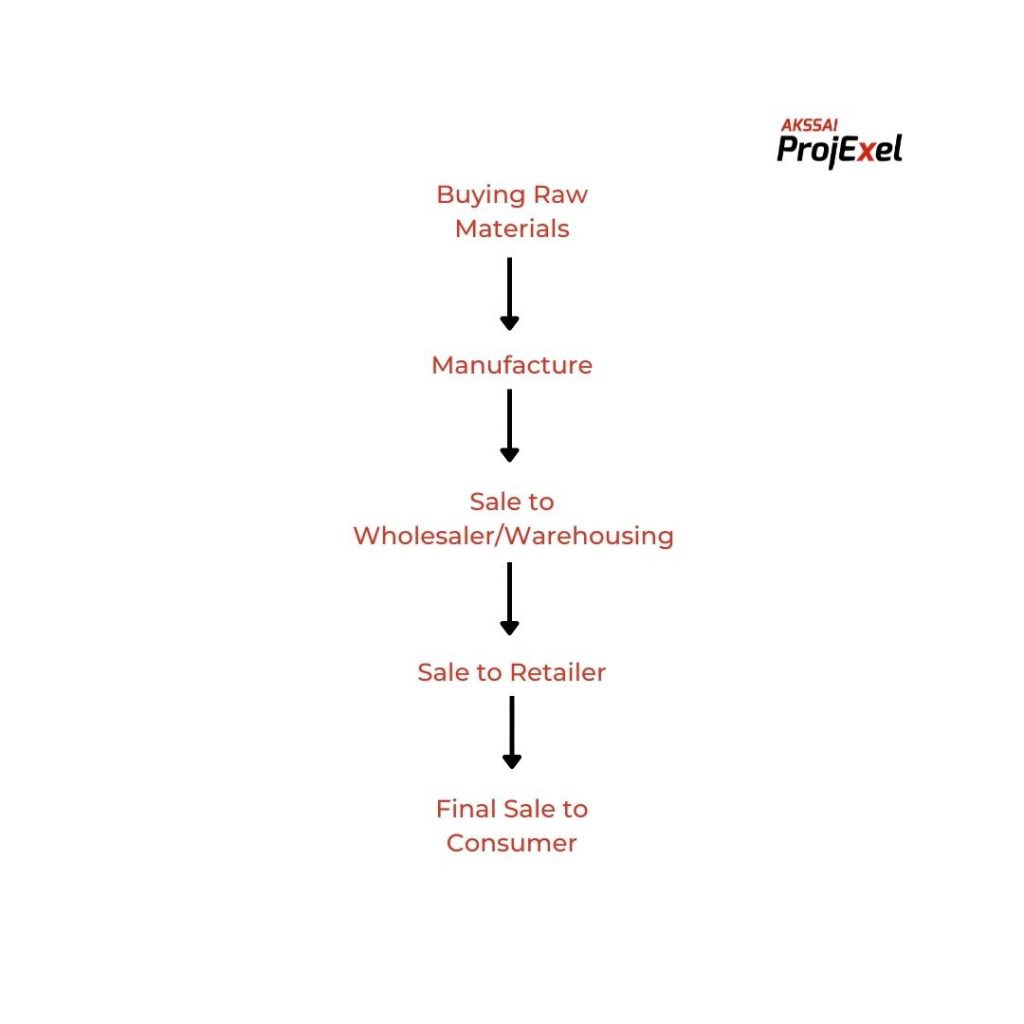

Multi-level

An object is going thru more than one change-of-arms alongside its deliver chain: Starting from manufacture till the very last sale to the customer.

Let us remember the subsequent degrees:

- Raw materials purchase

- Manufacture / Production

- of finished goods In Warehouses

- Goods Sale to wholesalers

- Sale of the product to the retailers

- Selling to the end consumers

The Goods and Services Tax is applied at each of these stages, making it a multi-stage tax.

Destination-Based

Consider items synthetic in Mumbai and bought to the very last customer in Bangalore. Since the Goods and Service Tax is levied on the factor of intake, the complete tax sales will visit Bangalore and now no longer Mumbai.

Value Addition

A producer who makes Cake buys flour, sugar and different material. The fee of the inputs will increase while the sugar and flour are combined and baked into Cake.

The producer then sells those cakes to the warehousing agent who packs huge portions of cakes in cartons and labels it. This is some other addition of fee to the cakes. After this, the warehousing agent sells it to the store.

The store programs the cakes in smaller portions and invests withinside the advertising of the cakes, for this reason growing its fee. GST is levied on those fee additions, i.e. the financial fee brought at every level to obtain the very last sale to the ceased customer.

2. Objectives Of GST

To obtain the ideology of ‘One Nation, One Tax’

GST has changed more than one oblique taxes, which had been present beneathneath the preceding tax regime. The gain of getting one unmarried tax way each nation follows the identical price for a selected product or provider. Tax management is less complicated with the Central Government identifying the fees and policies. Common legal guidelines may be added, consisting of e-manner payments for items shipping and e-invoicing for transaction reporting. Tax compliance is likewise higher as taxpayers aren’t slowed down with more than one go back bureaucracy and deadlines. Overall, it’s a unified gadget of oblique tax compliance.

To subsume a majority of the oblique taxes in India

India had numerous erstwhile oblique taxes consisting of provider tax, Value Added Tax (VAT), Central Excise, etc., which was once levied at more than one deliver chain degrees. Some taxes had been ruled through the states and a few through the Centre. There become no unified and centralised tax on each item and offering. Hence, GST become added. Under GST, all of the essential oblique taxes had been subsumed into one. It has significantly decreased the compliance burden on taxpayers and eased tax management for the authorities.

To get rid of the cascading impact of taxes

One of the number one goals of GST become to dispose of the cascading impact of taxes. Previously, because of specific oblique tax legal guidelines, taxpayers couldn’t prompt the tax credit of 1 tax towards the difference. For instance, the excise responsibilities paid all through manufacture couldn’t be prompt towards the VAT payable all through the sale. This caused a cascading impact of taxes. Under GST, the tax levy is most effective at the internet fee brought at every level of the deliver chain. This has helped get rid of the cascading impact of taxes and contributed to the seamless float of enter tax credit throughout each items and offerings.

To minimize tax evasion

GST legal guidelines in India are some distance greater stringent in comparison to any of the erstwhile oblique tax legal guidelines. Under GST, taxpayers can declare an enter tax credit score most effective on invoices uploaded through their respective suppliers. This manner, the possibilities of saying enter tax credit on faux invoices are minimal. The creation of e-invoicing has in addition bolstered this goal. Also, because of GST being a national tax and having a centralised surveillance gadget, the clampdown on defaulters is faster and some distance greater efficient. Hence, GST has curbed tax evasion and minimised tax fraud from taking area to a huge extent.

To growth the taxpayer base

GST has helped in widening the tax base in India. Previously, every of the tax legal guidelines had a specific threshold restrict for registration primarily based totally on turnover. As GST is a consolidated tax levied on each items and offerings each, it has multiplied tax-registered organizations. Besides, the stricter legal guidelines surrounding enter tax credit have helped carry sure unorganised sectors beneathneath the tax internet. For instance, the development enterprise in India.

Online methods for ease of doing commercial enterprise

Previously, taxpayers confronted loads of hardships coping with specific tax government beneathneath every tax regulation. Besides, even as go back submitting become on-line, maximum of the evaluation and refund methods came about offline. Now, GST methods are performed nearly absolutely on-line. Everything is executed with a click on of a button, from registration to go back submitting to refunds to e-manner invoice era. It has contributed to the general ease of doing commercial enterprise in India and simplified taxpayer compliance to a huge extent. The authorities additionally plans to introduce a centralised portal quickly for all oblique tax compliance consisting of e-invoicing, e-manner payments and GST go back submitting.

An advanced logistics and distribution gadget

A unmarried oblique tax gadget reduces the want for more than one documentation for the deliver of products. GST minimises transportation cycle times, improves deliver chain and turnaround time, and results in warehouse consolidation, amongst different benefits. With the e-manner invoice gadget beneathneath GST, the elimination of interstate checkpoints is maximum useful to the world in enhancing transit and vacation spot efficiency. Ultimately, it allows in slicing down the excessive logistics and warehousing costs.

To sell aggressive pricing and growth intake

Introducing GST has additionally caused a growth in intake and oblique tax revenues. Due to the cascading impact of taxes beneath neath the preceding regime, the expenses of products in India had been better than in international markets. Even among states, the decreased in VAT fees in sure states caused an imbalance of purchases in those states. Having uniform GST fees have contributed to universal aggressive pricing throughout India and on the worldwide front. This has consequently multiplied intake and caused better revenues, which has been some other essential goal achieved.

3. The Journey of GST in India

The GST adventure began in the year 2000 when a committee was formed to write down the rules. Since then it took 17 years for the law to develop. In 2017, the GST Bill was passed by the Lok Sabha and Rajya Sabha. The GST Act came into force on July 1, 2017.

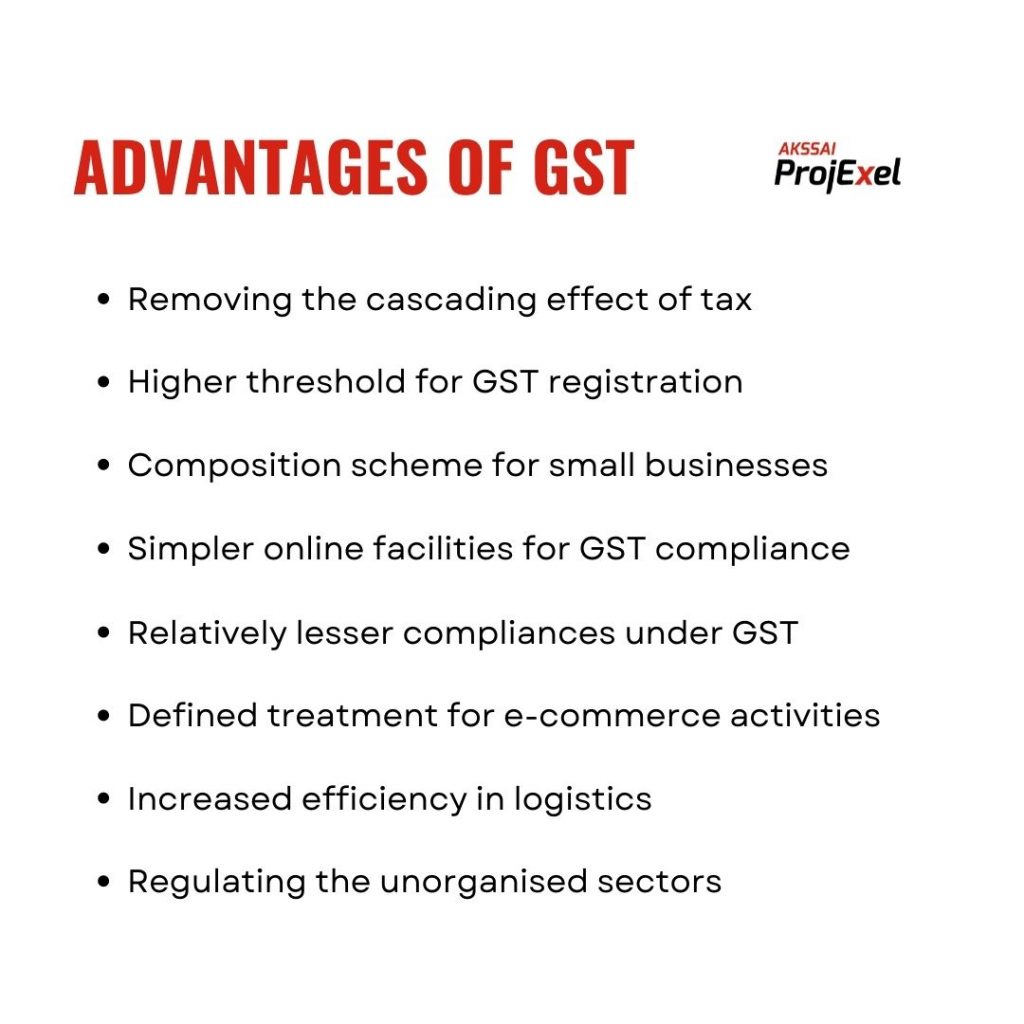

4. Advantages Of GST

GST has particularly eliminated the cascading impact at the sale of products and offerings. Removal of the cascading impact has impacted the fee of products. Since the GST regime removes the tax on tax, the fee for products decreases.

Also, GST is particularly technologically driven. All the sports like registration, go back submitting, the utility for refund and reaction to be aware wishes to be executed online at the GST portal, which speeds up the processes.

5. What are the additives of GST?

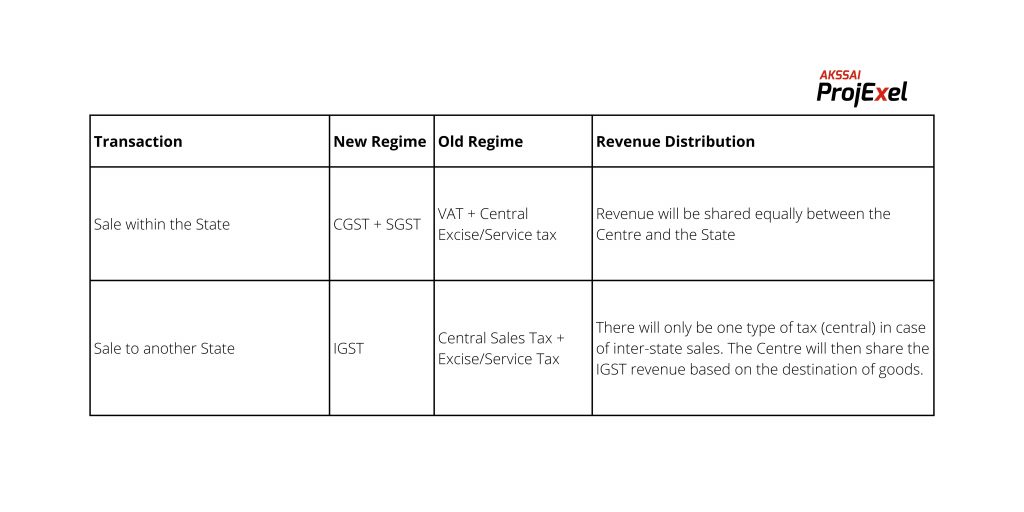

There are 3 taxes relevant beneath neath this gadget: CGST, SGST & IGST.

- CGST: It is the tax accrued through the Central Government on an intra-nation sale (e.g., a transaction taking place inside Maharashtra)

- SGST: It is the tax accrued through the national authorities on an intra-nation sale (e.g., a transaction taking place inside Maharashtra)

- IGST: It is a tax accrued through the Central Government for an inter-nation sale (e.g., Maharashtra to Tamil Nadu)

In maximum cases, the tax shape beneath neath the brand new regime may be as follows:

Sale to some other State IGST Central Sales Tax + Excise/Service Tax There will most effective be one sort of tax (central) in case of inter-nation income. The Centre will then proportion the IGST sales primarily based totally at the vacation spot of products.

Illustration:

- Let us assume that a dealer in Uttar Pradesh had sold the goods to a dealer in Madhya Pradesh worth Rs. 100,000. The tax rate is 18% comprising of only IGST.

In such a case, the dealer has to charge IGST of Rs.18,000. This revenue will go to Central Government.

- The same dealer sells goods to a consumer in Uttar Pradesh worth Rs. 100,000. The GST rate on goods is 12%. This rate comprises CGST at 6% and SGST at 6%.

The dealer has to collect Rs.12,000 as Goods and Service Tax, Rs.6,000 will go to the Central Government and Rs.6,000 will go to the Uttar Pradesh government since the sale is within the state.

6. Tax Laws earlier than GST

In the sooner oblique tax regime, there had been many oblique taxes levied through each nation and the centre. States particularly accrued taxes withinside the shape of Value Added Tax (VAT). Every nation had a specific set of guidelines and regulations.

Inter-nation sale of products become taxed through the centre. CST (Central State Tax) become relevant in the case of inter-nation sale of products. The oblique taxes consisting of the enjoyment tax, octroi and neighbourhood tax had been levied collectively through nation and centre. These caused loads of overlapping of taxes levied through each nation and the centre.

For instance, while items had been synthetic and bought, excise obligation become charged through the centre. Over and above the excise obligation, VAT becomes additionally charged through the nation. It caused a tax on tax impact, additionally referred to as the cascading impact of taxes.

The following is the listing of oblique taxes withinside the pre-GST regime:

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Central Excise Duty

- State VAT

- Central Sales Tax

- Special Additional Duty of Customs

- Luxury Tax

- Entertainment Tax

- Purchase Tax

- Cess

- Entry Tax

- Taxes on lotteries, betting, and gambling

- Taxes on advertisements

- CGST, SGST, and IGST have changed all of the above taxes.

However, sure taxes consisting of the GST levied for the inter-nation buy at a concessional price of 2% through the problem and utilisation of ‘Form C’ continues to be prevalent.

It applies to sure non-GST items consisting of:

- Petroleum crude;

- High-pace diesel

- Motor spirit (usually referred to as petrol);

- Natural gas;

- Aviation turbine fuel; and

- Alcoholic liquor for human intake.

It applies to the subsequent transactions most effective:

- Resale

- Use in production or processing

- Use in sure sectors consisting of the telecommunication network, mining, the era or distribution of power or every other electricity sector

7. How Has GST Helped in Price Reduction?

During the pre-GST regime, each purchaser, which includes the very last customer paid tax on tax. This circumstance of tax on tax is referred to as the cascading impact of taxes.

GST has eliminated the cascading impact.

Tax is calculated most effective at the fee-addition at every level of the switch of ownership. Understand what the cascading impact is and the way GST allows through looking at this easy video:

The oblique tax gadget beneath neath GST will combine the united states with a uniform tax price. It will enhance the gathering of taxes, in addition, to raising the improvement of the Indian economic system through doing away with the oblique tax boundaries among states.

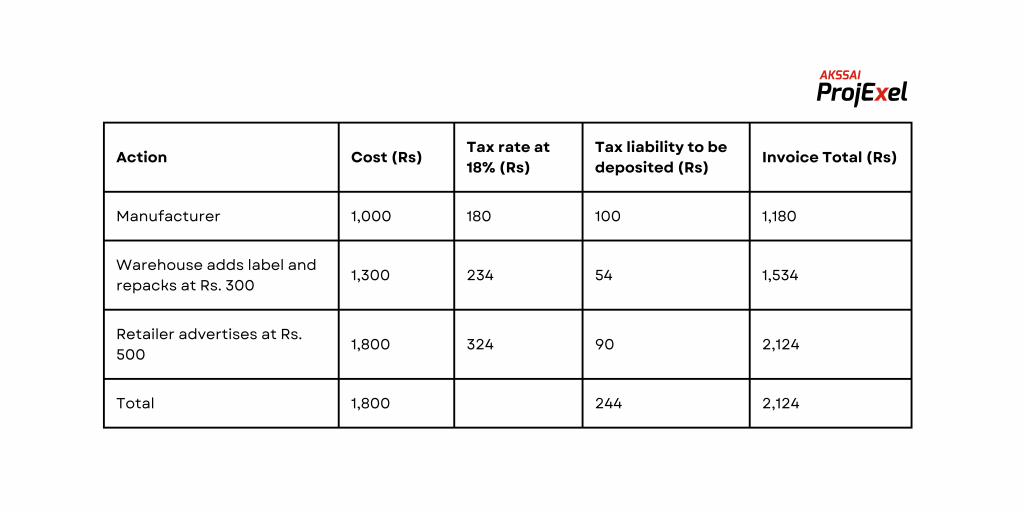

Illustration:

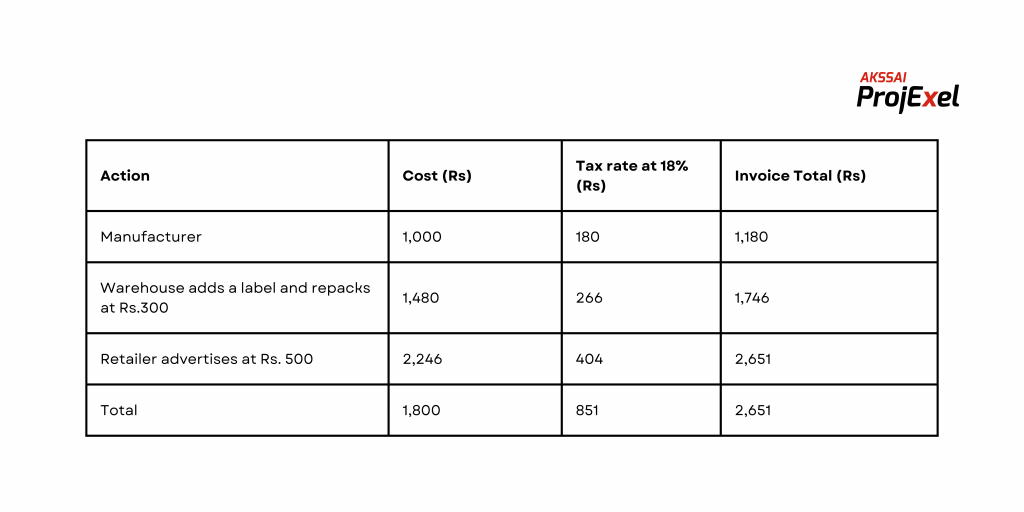

Based at the above instance of the biscuit producer, let’s take a few real figures to peer what occurs to the fee of products and the taxes, through evaluating the sooner GST regimes.

Tax calculations in in advance regime:

The tax legal responsibility become exceeded at each level of the transaction, and the very last legal responsibility involves a relaxation with the customer. This circumstance is referred to as the cascading impact of taxes, and the fee of the object continues growing on every occasion this occurs.

Tax calculations in present day regime:

xxxxxx

In the case of Goods and Services Tax, there’s a manner to say the credit score for tax paid in obtaining enter. The character who has already paid a tax can declare credit score for this tax while he submits his GST returns.

In the case, on every occasion a character is capable of claiming the enter tax credit score, the sale charge is decreased and the fee charged for the purchaser is decreased due to decrease tax legal responsibility. The very last fee of the biscuits is consequently decreased from Rs.2,244 to Rs.1,980, for this reason decreasing the tax burden at the very last customer.

8. What are the New Compliances Under GST?

Apart from online submitting of the GST returns, the GST regime has added numerous new structures alongside it.

e-Way Bills

GST added a centralised gadget of waybills through the creation of “E-manner payments”. This gadget become released on 1st April 2018 for inter-nation motion of products and on fifteenth April 2018 for intra-nation motion of products in a staggered manner.

Under the e-manner invoice gadget, manufacturers, investors and transporters can generate e-manner payments for the products transported from the area of its foundation to its vacation spot on a not unusual place portal with ease. Tax government also are benefited as this gadget has decreased time at check -posts and allows lessen tax evasion.

E-invoicing

The e-invoicing gadget becomes made relevant from 1st October 2020 for organizations with an annual mixture turnover of greater than Rs.500 crore in any previous monetary years (from 2017-18). Further, from 1st January 2021, this gadget becomes prolonged to people with an annual mixture turnover of greater than Rs.one hundred crore.

These organizations ought to acquire a completely unique bill reference range for each commercial enterprise-to-commercial enterprise bill through importing at the GSTN’s bill registration portal. The portal verifies the correctness and genuineness of the bill. Thereafter, it authorises the usage of the virtual signature alongside a QR code.

e-Invoicing permits interoperability of invoices and allows lessen information access errors. It is designed to byskip the bill facts immediately from the IRP to the GST portal and the e-manner invoice portal. It will, consequently, get rid of the requirement for guide information access even as submitting GSTR-1 and allows withinside the era of e-manner payments too.