Ensure accurate financial reporting. Our services simplify compliance with SEBI regulations, providing transparent financial statements for informed decision-making.

Effortlessly prepare financial statements. Our platform generates accurate balance sheets, income statements, and cash flows, providing insights for informed decision-making.

Simplify your fund accounting. Our services handle NAV calculation, subscription processing, and performance reporting, optimizing operations for AIFs and investors.

Ensure seamless compliance. We offer tax planning and filings, regulatory filings, GST filings, and compliance support, reducing risks and enhancing operational efficiency.

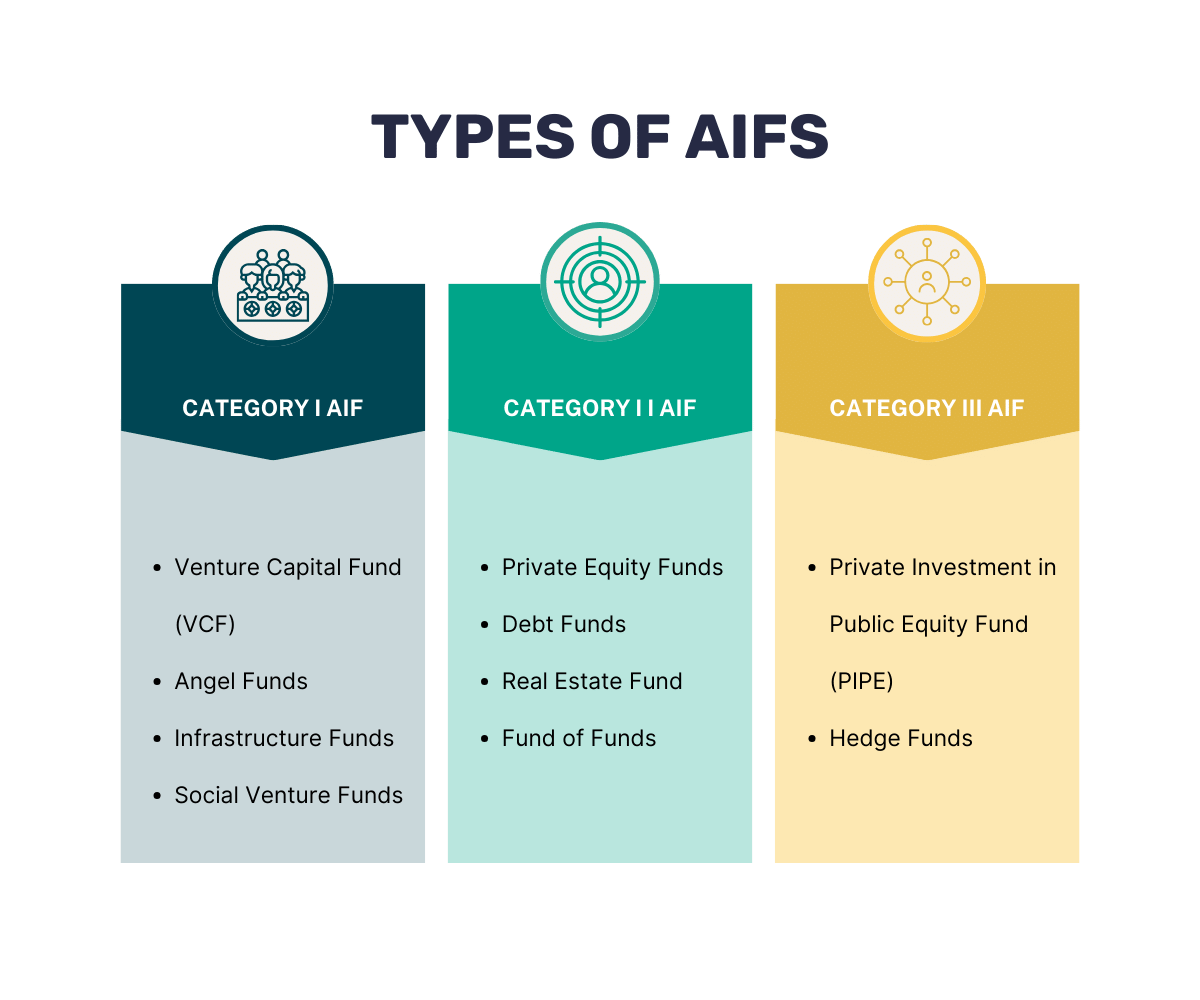

SEBI classifies Alternative Investment Funds (AIFs) into 3 categories:

Category I AIF:

Spread investments across various assets to reduce risk exposure and balance potential losses with gains from different sectors or regions.

Identify, assess, and address potential risks to protect investments and minimize the impact of adverse market conditions or unforeseen events.

Adhere to regulatory requirements and guidelines to ensure transparency, accountability, and investor protection within the AIF framework.

Conduct extensive research and analysis to evaluate investment opportunities, assess potential risks, and make informed decisions to safeguard investor interests.

Benefit from our AIF accounting expertise. We streamline operations, ensuring compliance and efficiency, allowing AIFs to focus on strategic growth initiatives.

Outsource accounting tasks. Our services free up time and resources, enabling AIFs to focus on core business activities and strategic growth initiatives.

Experience cost-effective solutions. Our platform reduces overheads, improving operational efficiency and financial performance for SEBI-registered AIFs.

Access updated and latest technology. We use Finac our advanced accounting solution software for streamlining financial reporting, compliance, and fund administration for SEBI AIFs.

Mitigate compliance risks. Our services ensure adherence to SEBI regulations, reducing the risk of penalties and enhancing investor confidence.

Happy Customers

Team Members

Offices in India & World Wide

We respect your privacy, our privacy policy