The Union Budget speech of July 2024 highlighted the necessity of a comprehensive revision of the Income-tax Act, 1961. The Hon’ble Finance Minister underscored the need for a tax law Income Tax Bill 2025 that is more concise, clear, and easier to understand.

The Income Tax Bill 2025 is a significant step in that direction, aiming to modernize tax legislation, remove redundant provisions, and simplify compliance procedures for taxpayers.

Applicability: Who Needs to Know? Understanding the Scope of the New Tax Bill

The Income Tax Bill 2025 is set to replace the existing Income-tax Act, 1961, and will come into effect from April 1, 2026. It will apply to all individuals, businesses, and entities subject to income tax in India.

The new framework ensures a seamless transition, with provisions addressing pre-2026 tax periods through repeals and savings clauses.

Taxpayers, including salaried employees, corporations, non-profit organizations, and foreign entities operating in India, must familiarize themselves with the changes to ensure compliance with the revised regulations

Need for Simplification: From Complexity to Clarity; Why India’s Tax Law is Getting a Makeover

The Income-tax Act, 1961, has undergone nearly 4,000 amendments over the years, resulting in a highly complex legal framework. This continuous layering of changes has made the Act cumbersome, with intricate cross-references and outdated provisions leading to difficulties in interpretation and compliance.

Recognizing the need for a streamlined approach, the new Bill emphasizes structural rationalization and linguistic simplification, drawing from global best practices in tax legislation.

Key Features of the New Income Tax Bill 2025: Breaking Down the Changes: What’s New in Income Tax 2025?

1. Rationalization of Tax Provisions

The Bill introduces several reforms aimed at improving readability and ease of compliance:

1. Reduction in Length: The new Bill is nearly half the length of the existing Act, ensuring a more concise legal framework.

▶ Simplified Drafting Style: The provisions have been redrafted in a straightforward manner, incorporating 57 tables as compared to 18 tables in the current Act, thereby reducing complexity.

▶ Streamlined Provisions: Instead of using multiple provisos and explanations, provisions have been consolidated into sub-sections and clauses, minimizing legal ambiguities.

▶ Elimination of Provisos and Explanations: More than 1,200 provisos and 900 explanations have been removed or incorporated within the main text, simplifying interpretation.

2. Refined Cross-Referencing: The Bill replaces complex references with a simplified citation system to improve clarity.

2. Transition from ‘Previous Year’ and ‘Assessment Year’ Concepts

A significant change in the Bill is the elimination of the ‘Previous Year’ and ‘Assessment Year’ concepts, replaced by:

Tax Year: The unit period for taxation, simplifying compliance.

Financial Year: Used for compliance timelines and procedural obligations.

This change is designed to make tax compliance more straightforward, particularly for new taxpayers.

3. Streamlining Compliance for Trusts and Non-Profit Organizations

The tax provisions for Non-Profit Organizations (NPOs), previously scattered across multiple sections, have now been consolidated into a dedicated chapter (Part B of Chapter XVII: Special Provisions for Registered Non-Profit Organizations). This restructuring simplifies compliance and reduces administrative burdens.

4. Reforming TDS and TCS Compliance

To make Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) compliance easier, the new Bill:

Introduces separate tables for transactions involving residents and non-residents.

▶ Clearly specifies situations where no deduction at source is required.

Reduces administrative complexity by improving procedural clarity.

Extensive Stakeholder Consultation: Shaping Tax Laws with Collective Wisdom

The drafting of the Bill involved a detailed consultative process, incorporating 20,976 online suggestions from various stakeholders, including:

▶ Industry and Professional Associations

- Income Tax Department Officials

- International Tax Authorities, including the Australian Tax Office and the UK’s Office of Tax Simplification

Additionally, the government studied prior tax reform documents from 2009 and 2019, as well as legal drafting best practices to ensure an efficient legislative framework.

Tax Law Reform: Simplified, Streamlined, and More Accessible for All

The new Bill enhances clarity and usability through several structural improvements:

▶ Plain Language: The traditional legal language has been replaced with a more accessible drafting style.

▶ Tabular Representation: Key sections, such as TDS provisions and exemptions under Section 10, have been reorganized into tables for improved comprehension.

▶ Consolidation of Similar Provisions: Tax provisions covering the same issues have been merged, reducing redundancies and ambiguity.

▶ Use of Formulae and Tables: Complex tax calculations have been formatted into clear tables and formulae.

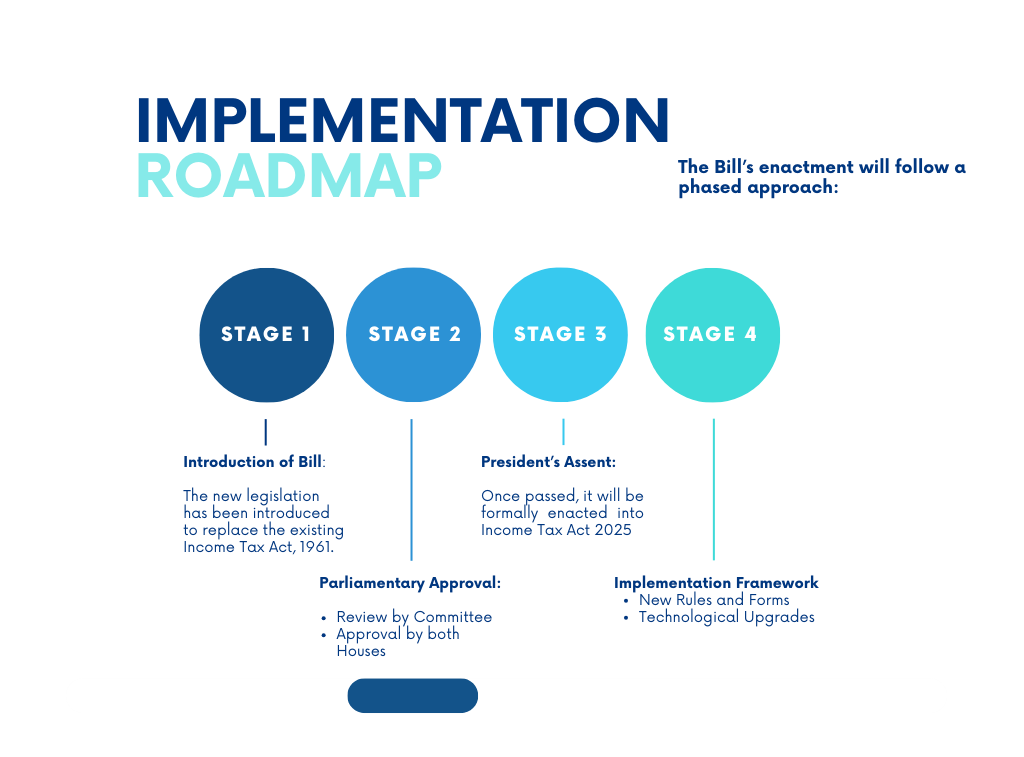

Path to Execution: The Implementation Roadmap

The enactment of the Bill will proceed in stages. After its introduction, the Bill will be reviewed by parliamentary committees and must be approved by both houses of Parliament. Following parliamentary approval, it will be forwarded for the President’s assent. Once approved, the Bill will be enacted into law.

Ensuring a Smooth Transition: Provisions for Compliance Before April 2026

The Repeals and Savings clause in the Bill ensures that all rights, liabilities, and obligations under the existing law remain safeguarded.

Tax laws applicable to periods prior to April 1, 2026, will continue to be recognized for compliance purposes.

Conclusion: Final Thoughts and Way Forward

The Income Tax Bill 2025 represents a transformative effort to simplify tax laws, reduce litigation, and enhance compliance efficiency. By removing outdated provisions, employing clearer language, and restructuring key compliance frameworks, the Bill aims to make tax administration more transparent, predictable, and user-friendly.

As the Bill moves through the legislative process, taxpayers and professionals should stay informed and prepare for the upcoming changes. The restructured tax system will significantly reduce complexities and align with global best practices, ensuring a more efficient tax regime for all stakeholders.