In today’s rapidly evolving business landscape, the finance industry is undergoing a shift towards digital transformation. Digital transformation in financial services is not just a trend, it’s a necessity for businesses aiming to remain competitive and agile.

As a leading provider of corporate services encompassing HR, Tax, Accounting, IT, Marketing, and more, our organization recognizes the pivotal role that digital transformation plays in modern finance. In this comprehensive blog post, we will delve into the concept of digital transformation in finance, its numerous advantages and challenges, and how our organization is actively contributing to the digitization of financial services.

What is Digital Transformation in Finance?

Digital transformation in finance refers to the integration of digital technology into all areas of financial operations, fundamentally changing how businesses manage their financial resources, processes, and data. It’s not limited to just adopting new software or tools; rather, it’s a holistic approach that redefines the entire financial ecosystem.

Digital transformation in financial services is a journey that presents both opportunities and challenges. By embracing this transformation, organizations can streamline their financial operations, enhance customer experiences, and gain a competitive edge in an increasingly digital world.

Digital transformation in financial services is a journey that presents both opportunities and challenges. By embracing this transformation, organizations can streamline their financial operations, enhance customer experiences, and gain a competitive edge in an increasingly digital world.

This transformation encompasses various facets, including:

1. Automated Processes: The automation of routine financial tasks, such as data entry, reconciliation, and reporting, using cutting-edge technologies like robotic process automation (RPA) and artificial intelligence (AI).

2. Data Analytics: Leveraging data analytics to gain valuable insights into financial data, enabling better decision-making and forecasting.

3. Cloud Computing: Migrating financial data and applications to the cloud for improved accessibility, scalability, and security.

4. Mobile and Online Banking: Providing customers with seamless digital banking experiences, including mobile apps and online banking platforms.

5. Blockchain and Cryptocurrency: Exploring blockchain technology and cryptocurrencies to enhance security and efficiency in financial transactions.

6. Cybersecurity: Implementing robust cybersecurity measures to protect sensitive financial information from cyber threats.

Looking for experts to digitally transform your finances? Let us help you

What are the Benefits of Digital Transformation in Finance?

Digitization in finance offers a multitude of benefits that can positively impact businesses of all sizes. Here are some key advantages:

1. Enhanced Efficiency:

Digital transformation in finance introduces automation across financial workflows, significantly reducing manual errors. This accelerates the speed at which financial tasks are completed.

With routine and time-consuming tasks delegated to digital systems, finance teams can reallocate their energy and expertise toward more strategic and value-added endeavors. This enhances overall operational efficiency.

2. Cost Savings:

Digital transformation optimizes processes by eliminating bottlenecks and inefficiencies, leading to substantial long-term cost savings.

As the reliance on physical paperwork diminishes, so does the need for extensive physical infrastructure, filing cabinets, and storage space. This translates into lower overhead costs, a welcome relief for businesses of all sizes.

3. Data-Driven Decision Making:

One of the most compelling advantages of digital transformation in financial services is the ability to access real-time data. Advanced analytics tools provide organizations with comprehensive insights into financial data, enabling them to make informed decisions promptly.

With data-driven insights, businesses can swiftly respond to market changes and emerging trends, ensuring their strategies remain agile and aligned with current conditions.

4. Improved Customer Experience:

The numerous digital channels and self-service options allow customers to access their financial information and services 24/7.

Through data analytics and digital interactions, financial institutions can tailor their services to individual customer needs, offering a more personalized and engaging experience.

5. Global Reach:

Cloud-based solutions form the backbone of digital transformation in finance, enabling businesses to expand their operations globally with remarkable ease. Gone are the days of needing extensive physical infrastructure in every new market.

The scalability of cloud-based systems allows financial institutions to adapt to varying demands and quickly adjust their resources in response to market fluctuations.

6. Security:

The digital transformation in financial services isn’t just about efficiency; it’s also about robust security. Implementing strong cybersecurity measures becomes a priority that ensures the safeguarding of sensitive financial data and customer information.

Enhanced security fosters trust and confidence among customers, who are assured that their financial transactions and data are protected.

Insights From Surveys on Digital Transformation in Finance

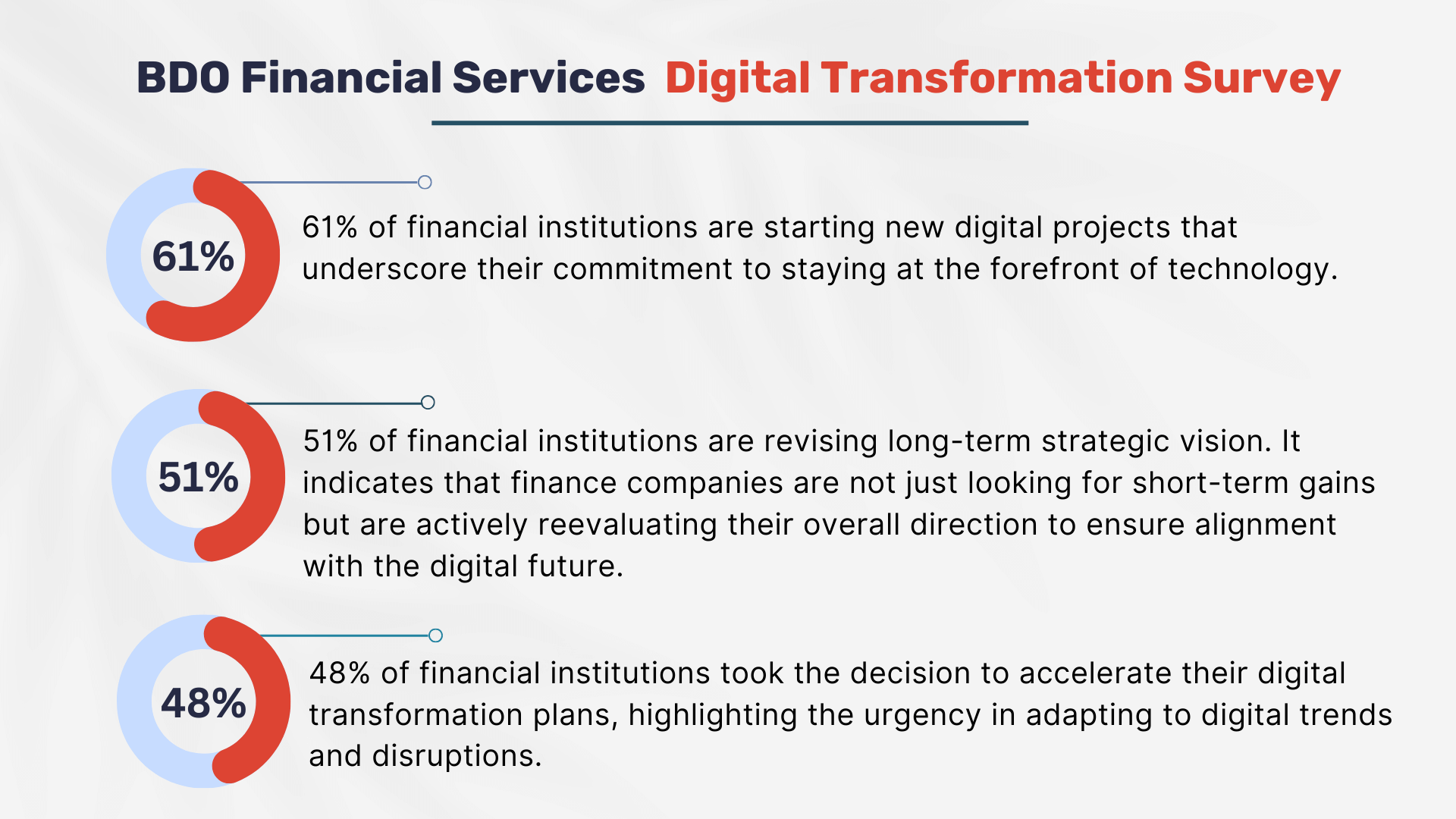

BDO Survey

Here are some interesting statistics from the Financial Services Digital Transformation Survey, highlighting the strong emphasis on digital transformation in financial services. These insights reflect the industry’s recognition of the need to adapt and thrive in an increasingly digital and competitive landscape.

Here’s a breakdown of the key takeaways from the survey:

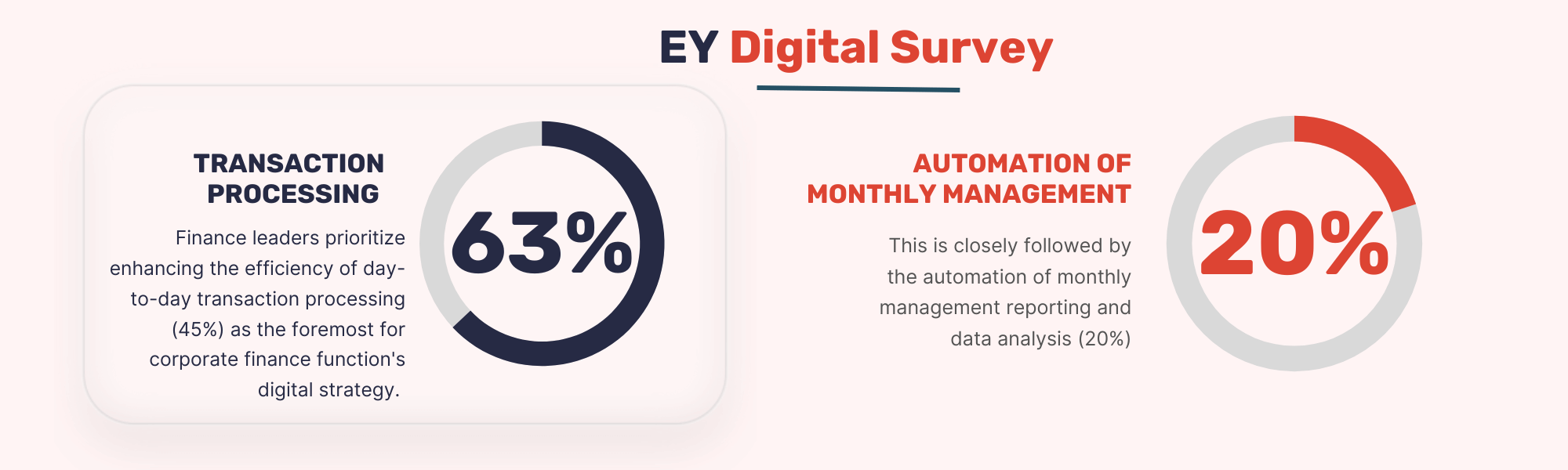

EY Survey

The EY Digital survey shows that finance leaders are directing their efforts toward the transformative journey of finance, with technology and digital transformation playing a pivotal role.

These statistics show that the financial sector is fully aware of the benefits of digital transformation, such as enhanced agility, resilience, and improved customer experiences.

What are the Challenges of Digital Transformation in Finance?

While the benefits of digital transformation in finance are undeniable, the journey is not without its challenges:

1. Resistance to Change:

New technologies often face resistance from employees accustomed to existing processes. This resistance can slow down the adoption of digital solutions and hinder the transformation process.

Effective change management strategies are imperative to mitigate resistance. Organizations must communicate the benefits of digital transformation in financial services clearly, provide training and support, and foster a culture that embraces innovation and change.

2. Data Security Concerns:

With the increasing digitization of financial data, the risk of data breaches and cyberattacks heightens.

To address these concerns, organizations must invest in robust cybersecurity measures. This includes advanced encryption, intrusion detection systems, regular security audits, and employee training to recognize and prevent cyber threats.

3. High cost of implementation:

Implementing digital solutions can be expensive, especially for smaller organizations with limited budgets. This can make it difficult for finance leaders to justify the investment in new technologies.

4. Regulatory Compliance:

The financial sector is subject to a plethora of evolving regulations and compliance standards. Navigating this complex regulatory landscape can be both challenging and costly.

Organizations must have a dedicated focus on compliance. This often requires building or partnering with compliance experts who can ensure that all the initiatives in digital transformation in financial services follow strict adherence to relevant regulations.

5. Integration Issues:

Many financial institutions rely on legacy systems that have been in place for years. Integrating these aging systems with new digital solutions can be a daunting task.

6. Skill Gaps:

As organizations embrace digital transformation, they may find a shortage of talent with the necessary digital skills.

For this challenge, businesses will have to invest in talent development programs, upskilling existing employees, and strategically recruiting individuals with digital expertise.

7. Costs:

The upfront costs of implementing new technologies and providing training can be substantial, although the long-term benefits often outweigh these costs.

8. Lack of standardization:

The lack of standardization in digital solutions can make it difficult for finance leaders to compare and evaluate different tech.

Want to know how we can help you towards a digitally transformed financial future? ——-> Contact Us

How can AKSSAI Help in Digitizing Financial Services?

At AKSSAI, we understand the significance of digital transformation in finance and the evolving landscape of financial services. We have taken a proactive approach to help businesses navigate these changes and reap the rewards of digitization.

Here’s an in-depth look at how AKSSAI contributes to the digitization of financial services and enables our clients to seize the opportunities presented by the digital revolution:

1. Comprehensive Digital Solutions:

Our suite of digital solutions is meticulously crafted to cater to the distinct and evolving needs of our clients. These encompass a wide range of offerings, including but not limited to:

- Cloud-Based Accounting Software: Our cutting-edge cloud-based accounting software, Finac, simplifies financial record-keeping and enables real-time access to financial data from anywhere, facilitating faster decision-making. Finac is powered by 150+ industry-first features that help you keep all your financial data organized and secure.

- Automated Payroll Systems: Our automated payroll systems streamline payroll processing, reducing manual errors, ensuring timely salary disbursements, and enhancing employee satisfaction.

- Digital Tax Services: Leveraging digital platforms, we offer a comprehensive suite of tax services that simplify tax compliance, minimize liabilities, and maximize returns for our clients.

2. Expertise in Compliance:

In the ever-evolving landscape of financial regulations and compliance standards, staying updated is non-negotiable. Our team of seasoned experts is dedicated to monitoring and comprehending these dynamic changes. This ensures that our clients remain fully compliant with the latest regulations in the digital realm, safeguarding their reputation and financial well-being.

3. Data Analytics:

Our data-driven approach enables our clients to make informed decisions, identify emerging trends, and seize opportunities with precision and confidence. By unlocking the potential hidden within their data, organizations can navigate complex financial landscapes with clarity.

4. Training and Support:

We understand that the successful adoption of digital tools and technologies hinges on the competence of the individuals who use them. To this end, we offer comprehensive training programs tailored to equip our clients’ employees with the requisite skills and knowledge. Through hands-on training and ongoing support, we empower teams to effectively navigate the digital landscape, fostering confidence and proficiency.

5. Customized Strategies:

Recognizing that every business is unique, our experienced consultants work closely with our clients to co-create customized digital transformation strategies. These strategies are intricately aligned with their specific business objectives, ensuring that the digitization journey is not just a one-size-fits-all approach but a tailored roadmap to success.

Case Studies: AKSSAI’s Customer Success Stories

To illustrate the impact of digital transformation in finance, let’s explore a few case studies of clients who have partnered with AKSSAI to embrace this transformative journey:

Case Study 1: Streamlining Accounting Processes

A medium-sized manufacturing company was struggling with manual accounting processes, leading to errors and delays in financial reporting. With the help of Finac, our accounting software, we automated their financial workflows, reducing errors by 30% and accelerating reporting times by 50%.

Case Study 2: Enhancing Tax Compliance

A multinational corporation faces challenges in managing tax compliance across various jurisdictions. We deployed a digital tax compliance solution that centralized tax data and automated reporting, resulting in a 20% reduction in compliance-related costs.

Case Study 3: Improving HR Efficiency

A growing startup needed to scale its HR operations quickly. With the help of our HR and payroll system, we helped the organization reduce administrative overhead by 40% and enabled the company to focus on its core business activities.

How to Plan Digital Transformation in Finance?

As your organization embarks on the journey of digital transformation in finance, it’s essential to have a well-defined strategy in place. Here are some key steps and considerations to guide you on this transformative path:

1. Assessment and Planning:

Begin by conducting a thorough assessment of your current financial processes, systems, and technology infrastructure. Identify pain points, inefficiencies, and areas that could benefit from digitization. Once you have a clear picture, create a strategic roadmap for your digital transformation in financial services.

2. Set Clear Goals:

Define specific, measurable, and achievable goals for your digital transformation initiatives. Whether it’s improving efficiency, reducing operational costs, or enhancing customer experiences, having clear objectives will keep your team focused and motivated.

3. Invest in Talent:

Building a team with the right skills is critical to the success of your efforts in digital transformation in financial services. Ensure that your employees receive training and support to adapt to new technologies and processes. Consider hiring or partnering with experts in digital finance.

4. Choose the Right Technology:

Carefully evaluate and select technology solutions that align with your goals. Whether it’s implementing cloud-based accounting software, adopting data analytics platforms, or exploring blockchain for secure transactions, make informed technology choices.

5. Data Management and Security:

Data is at the heart of digital finance. Develop robust data management practices and prioritize data security. Compliance with data protection regulations is non-negotiable, so invest in state-of-the-art cybersecurity measures.

6. Change Management:

Anticipate resistance to change within your organization. Develop a change management plan that includes communication, training, and support for your employees. Encourage a culture of innovation and adaptability.

7. Customer-Centric Approach:

Digital transformation in finance should ultimately enhance the customer experience. Ensure that your digital initiatives are designed with your customer’s needs and preferences in mind. User-friendly interfaces, mobile accessibility, and responsive customer support are essential.

8. Monitor and Measure Progress:

Implement key performance indicators (KPIs) to track the progress and impact of your digital transformation initiatives. Regularly assess your results, make adjustments as needed, and celebrate milestones achieved.

9. Compliance and Regulations:

Stay abreast of evolving financial regulations and compliance standards. Ensure that your digital solutions are compliant with the laws and regulations relevant to your industry and geography.

10. Continuous Innovation:

Digital transformation in financial services is an ongoing process. Embrace a culture of continuous improvement and innovation. Encourage your team to explore emerging technologies and trends to stay ahead of the curve.

As the digital transformation in finance continues to evolve, it’s essential to keep an eye on emerging trends that will shape the industry in the coming years. Some noteworthy trends include:

Decentralized Finance (DeFi): DeFi platforms are revolutionizing traditional financial services by providing decentralized, blockchain-based alternatives to traditional banking and lending services.

Central Bank Digital Currencies (CBDCs): Several countries are exploring the issuance of their own digital currencies, which could reshape the global financial system and facilitate faster and more secure cross-border transactions.

AI-Powered Chatbots and Virtual Assistants: AI-driven chatbots and virtual assistants are becoming increasingly sophisticated, providing personalized customer service and support for financial inquiries.

Open Banking: Open banking initiatives are gaining traction, allowing consumers to share their financial data securely with third-party providers, leading to more innovative and competitive financial services.

Green Finance: Environmental, Social, and Governance (ESG) considerations are becoming central to financial decision-making, with the rise of sustainable and green finance options.

Biometric Security: Biometric authentication methods, such as facial recognition and fingerprint scanning, are enhancing the security of financial transactions and access to accounts.

Quantum Computing: While still in its infancy, quantum computing has the potential to revolutionize financial modeling, risk assessment, and cryptography.

Your Partner in Digital Transformation

Digital transformation in finance is no longer a choice; it’s a strategic imperative for businesses aiming to thrive in the digital age. The benefits of enhanced efficiency, cost savings, data-driven decision-making, and improved customer experiences are too compelling to ignore. However, it’s essential to acknowledge and address the challenges that come with this transformation.

By leveraging our comprehensive digital solutions, industry knowledge, and strategic alliances, you can navigate the challenges and seize the opportunities presented by the digital transformation in financial services. Together, we can empower your organization to thrive in the digital age and shape the future of finance.

At AKSSAI, we are not just a service provider; we are your partner on the path to digital transformation in financial services. Our dedicated team of experts is committed to guiding you through every stage of your journey, from initial assessment to implementation and ongoing support.

We are committed to assisting businesses in their digital transformation journeys. Through a combination of comprehensive digital solutions, expert guidance, and a focus on security and compliance, we empower organizations to embrace the future of financial services.

As we continue to navigate the ever-changing landscape of finance, we remain dedicated to staying at the forefront of digital innovation, ensuring our clients are well-equipped to thrive in the digital age. Embracing digital transformation in finance is not just a trend; it’s a strategic move toward a brighter and more efficient financial future. The future of finance is digital, and we are here to help you embrace it with confidence.

WANT TO HELP YOU TO ACHIEVE YOUR DIGITAL TRANSFORMATION GOALS

Learn how we can tailor our services to meet your specific needs